AI-Driven Growth. Research-backed strategies

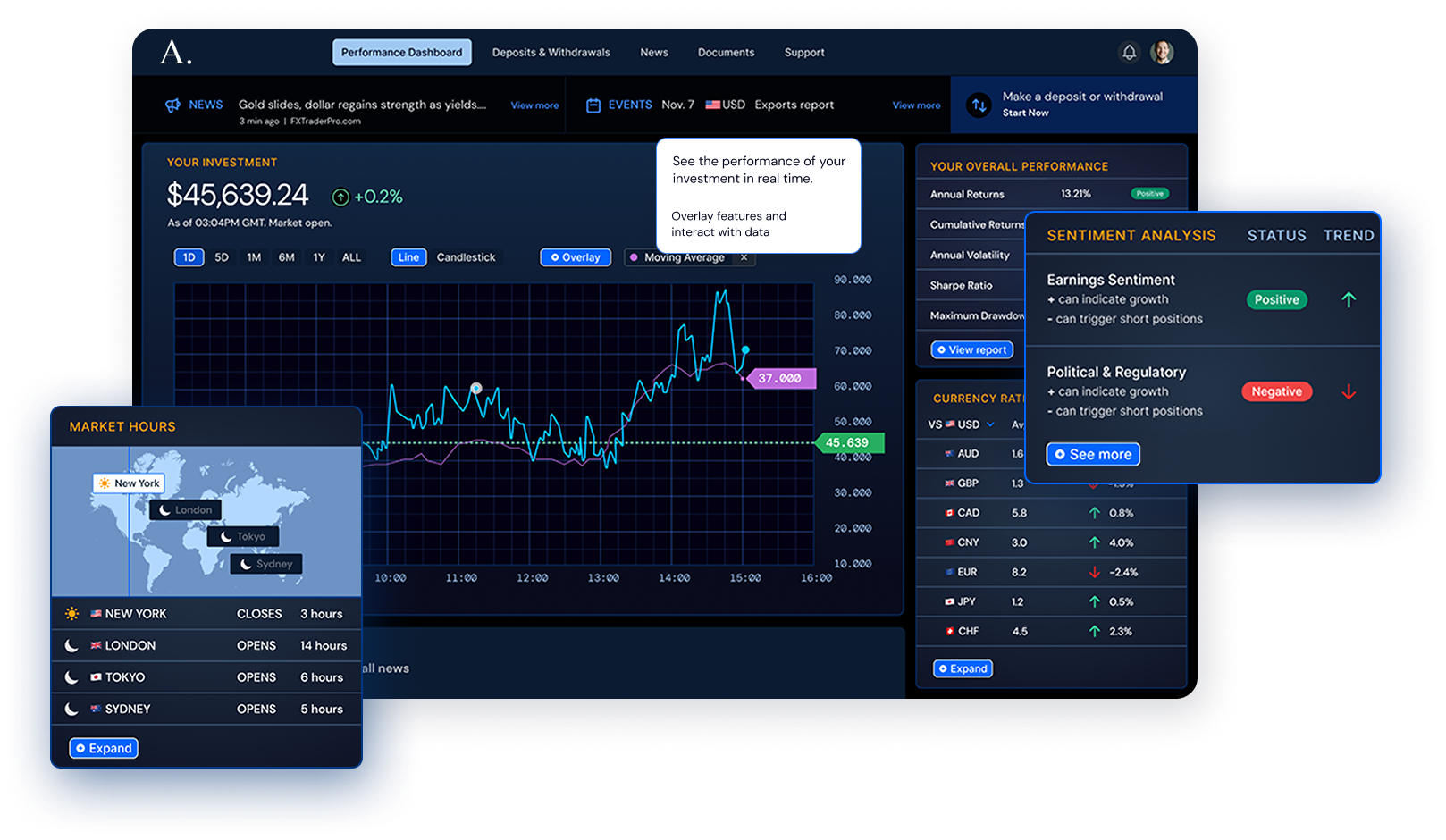

Track your portfolio performance, key metrics, and market activity—all in real time.

Gain deep insights into performance metrics, market sentiment, and machine learning-driven analysis to understand what drives your results.

Get reliable support and clear answers to your questions whenever you need them.

Coordinated agents are groups of specialized algorithms that work together in a structured hierarchy, each handling specific tasks while adapting to their environment.

This collaborative design allows them to tackle complex problems more efficiently and respond intelligently to changing conditions.

Explainable AI (XAI) focuses on making advanced machine learning models understandable by showing how decisions are made.

By revealing the key factors behind predictions, XAI builds

trust and helps users make better-informed decisions.

Reinforcement learning is a type of machine learning where algorithms improve through trial and error, learning how to make better decisions over time.

It’s particularly powerful for solving problems that involve planning and adapting to change.

Id distinctio Quis non odit harum cum unde commodi id rerum internos et quaerat voluptate. Aut modi dolores non fugit.

Id distinctio Quis non odit harum cum unde commodi id rerum internos et quaerat voluptate. Aut modi dolores non fugit.

Id distinctio Quis non odit harum cum unde commodi id rerum internos et quaerat voluptate. Aut modi dolores non fugit.

Id distinctio Quis non odit harum cum unde commodi id rerum internos et quaerat voluptate. Aut modi dolores non fugit.

Id distinctio Quis non odit harum cum unde commodi id rerum internos et quaerat voluptate. Aut modi dolores non fugit.

Mapping a control system onto a quantitative hedge fund is translated into system architecture with intelligent components.

Adapt to the complexity and shifting nature of an ever-changing, turbulent market. Continuously crafting new strategies to stay ahead of market trends.

Distilling clarity and insights from noisy market data, bringing form to the chaos.

The system balances exploration for new opportunities with exploitation of proven methods, incentivizing agents to optimize this dynamic for sustained adaptability and performance.

The system embodies the wisdom of a seasoned trading team by cultivating knowledge through the generational transference of experience from each prior life cycle of its agents.

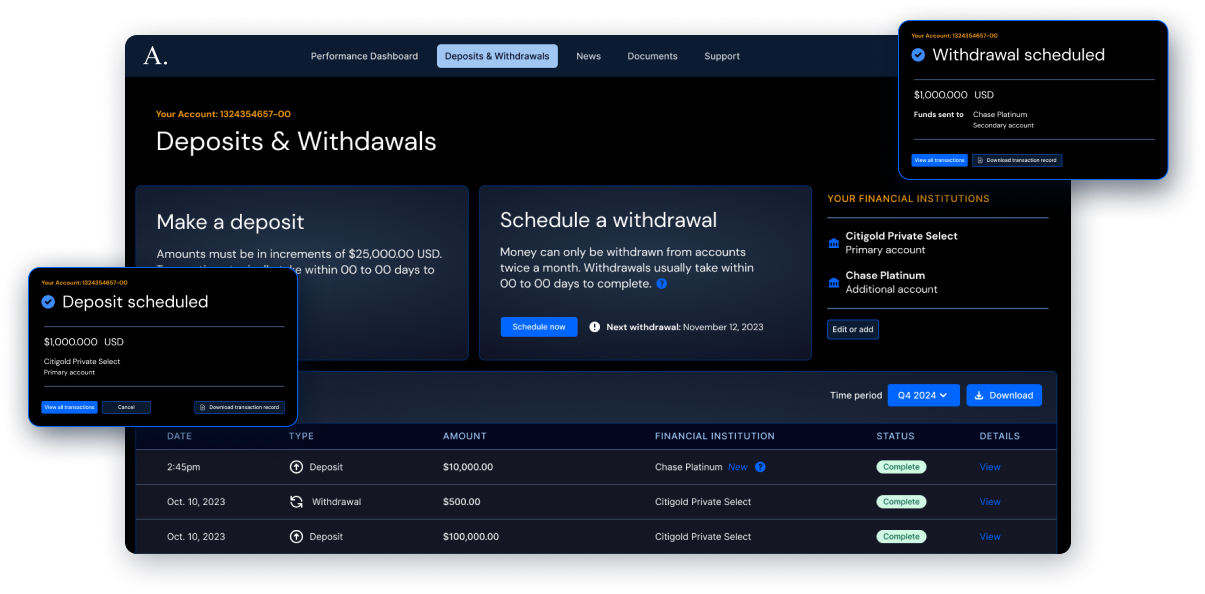

You retain full control over your investments.

Stay informed with daily investment performance updates.

Clear insights into technology, execution, and results.

Our customer support team is available to assist investors with any inquiries or issues. You can message them directly through your account with us at Argrand.

We design and build advanced machine learning algorithms and quantitative models that analyze market data, sentiment, and trends to optimize portfolios and manage risk, ensuring a data-driven approach to trading.

We employ a dynamic multi-strategy approach, where our machine learning algorithms continuously evaluate and adjust strategies based on real-time market data. This process not only optimizes the performance of individual strategies but also determines the optimal conditions to transition between strategies, effectively treating strategy selection itself as a strategic layer.

Your investment is secure and no, your funds remain in your brokerage account, fully secure and under your name. We only execute strategies on your behalf through your existing account, ensuring you retain full control, visibility, and peace of mind.

Identify market trends and patterns – execute profitable trading

opportunities – real-time investment performance